2024 Property Tax Billing

NOTICE OF PROPERTY TAX INCREASE

Every few years, the Gwinnett County Tax Assessor is required to review the assessed value of property in the county. When the trend prices of properties that have recently sold in the county indicate there has been a change in the fair market value of such property, the Tax Assessor may adjust the value of the real property located in Gwinnett County. This process is known as property reassessment.

The Dacula Mayor and Council has carried out a deliberate strategy over the last several years to keep City taxes low without negatively impacting the quality of the City services provided to its citizens. By adopting a millage rate of 4.557, which is the same as last year, the City of Dacula must advertise a tax increase.

The Mayor and Council of the City of Dacula, Georgia has tentatively adopted a 2024 millage rate which will require an increase in property taxes by 5.93 percent. All concerned citizens are invited to the public hearing on this tax increase to be held at Dacula City Hall, 442 Harbins Road, Dacula, GA on July 18, 2024 at 10 a.m. and 5:00 p.m. Times and places of additional public hearings on this tax increase are at Dacula City Hall, 442 Harbins Road, Dacula, GA on August 1, 2024 at 6:30 p.m. This tentative increase will result in a millage rate of 4.557 mills, an increase of .255 mills. Without this tentative increase, the millage rate will be no more than 4.302 mills. The proposed tax increase for a home with a fair market value of $350,000 is approximately $33.92 and the proposed tax increase for non-homestead property with a fair market value of $325,000 is approximately $33.15.

| Standard Homestead Property with a $350,000 FMV | |

| $350,000 | Fair Market Value |

| 40% | |

| 140,000 | Assessed Value |

| (7,000) | Standard Homestead Exemption for the City of Dacula |

| 133,000 | Taxable Value |

| 0.004557 | Proposed Millage Rate for 2024 (4.557 mills) |

| $606.08 | Taxes Due |

| Non-homestead Property with a $350,000 FMV | |

| $350,000 | Fair Market Value |

| 40% | |

| 140,000 | Assessed Value and Taxable Value |

| 0.004557 | Proposed Millage Rate for 2024 (4.557 mills) |

| $637.98 | Taxes Due |

**Note: Fair Market Value and Assessed Value can be found on your Notice of Assessment from the Gwinnett County Tax Assessor's Office.

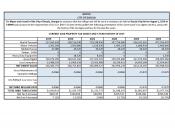

The Mayor and Council of the City of Dacula, Georgia do announce that the millage rate will be set at a meeting to be held at Dacula City Hall on August 1, 2024 at 7:00 PM and pursuant to the requirements of O.C.G.A. §48-5-32 does hereby publish the following presentation of the current year's tax digest and levy, along with the history of the tax digest and levy for the past five years.

Click on image to see the current 2024 Tax Digest and Five Year History of Levy